On Tuesday, Coty Inc. multiplied its estimate of both the fee – and price cuts – related to its deliberate acquisition of forty Procter &Gamble splendor brands.

The Big Apple city-based total maker of Rimmel make-up said the merger would include $1.2 billion in single-time fees, up from the $500 million envisioned in July when the deal was first announced. The organization, which additionally makes fragrances below license for Calvin Klein and different labels, stated it reduced $780 million in costs over four years, up from the preliminary $550 million over three years first mentioned.

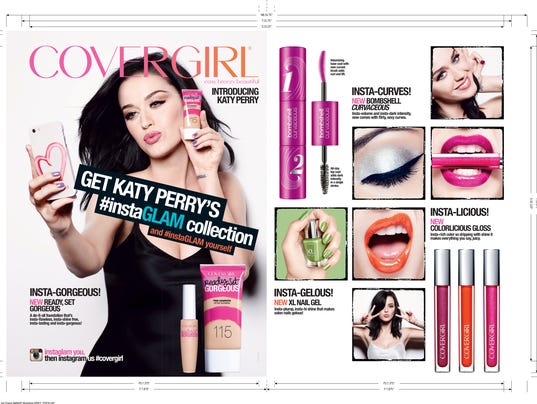

On the way to making CoverGirl make-up, Clairol, and Wella hair a part of Coty, the deal is expected to shut in October, the organization said. The exact shape of the transaction has no longer yet been finalized.

In a government submitting remaining month, Cincinnati-based P&G and Coty mentioned a transaction plan that might permit P&G to promote the cut-up-off beauty brands to P&G traders earlier than immediately merging with Coty. That P&G-prefered deal structure is contingent on sufficient P&G shareholders volunteering to tender their stocks in change for a chunk of a first-rate-sized Coty.

The identical filing also opens the opportunity for a spin-off where P&G could transfer ownership of the beauty brands to all P&G shareholders. The brand new entity would merge with Coty right now. The transaction could feature as a one-time special stock dividend.

The deal will simplify P&G’s almost $20 billion beauty enterprise that Lafley helped create. It’ll reduce the business to roughly $14 billion in annual income and go away plenty more centered on hair and skincare sold at mass shops. P&G’s final splendor commercial enterprise could be anchored using Pantene, Head & Shoulders shampoos, Olay, and SKII skincare brands. Collectively, those manufacturers command more than $nine billion in annual income.

READ MORE :

- 5 Tips for Connecting With Wealthy Investors

- 10 Tips to Help Your Business Become More Profitable

- References to Jawaharlal Nehru dropped in new Rajasthan school textbook; Congress cries foul

- NIA officer’s killer identified, cops say property dispute main motive

- Virtual reality isn’t just for gaming – it could transform mental health treatment

The spin-off will affect 10,000 workers globally–at least eight percent of its whole body of workers, along with about 1,500 within the U.S. and two hundred in extra Cincinnati. The transaction can transfer ownership of eight factories and nine distribution centers, including 3 U.S. facilities.

Shifting the splendor emblem jobs from P&G’s payroll comes on top of P&G’s other emblem income, and the restructuring announced in 2012. All advised the enterprise will reduce 20,000 to 23,000 total positions from its 118,000 headcounts disclosed in August 2015 – a reduction of 16.7 to 19. Five percent over three years.